Access UBS Evo eInvoicing Software

Why Accounting eInvoicing?

eInvoice, mandated by the Inland Revenue Board (LHDN) of Malaysia, aims to enhance business efficiency and curb tax evasion. The implementation will occur gradually, starting in August 2024.

The E-Invoice workflow begins with a sale or transaction. Suppliers issue eInvoices through the MyInvois Portal or API. Validated eInvoices are stored in IRBM’s database, allowing taxpayers to view their historical eInvoices. This system simplifies the invoicing process, making it efficient and accessible for businesses of all sizes.

Take Back Control

Say goodbye to misplaced invoices and uncertainties about payment statuses. Easily monitor when your invoices are received, approved, and processed.

Save Time & Money

eInvoice ensures compliance while cutting costs and boosting efficiency. Businesses eInvoice also receive payments faster and financial stability.

Secure & Compliant

Seamless system integration ensures accurate tax reporting and aligns financial processes with digital industry standards, enhancing efficiency.

Good for the planet

Bid farewell to traditional paper invoices and email attachments that require manual review. Embracing digital invoices reduces paper usage, contributing to a greener environment.

When do you need to start Access UBS Accounting eInvoicing?

The implementation will occur gradually, starting in August 2024 as below:

1 Aug 2024 – For businesses with an annual turnover of RM 100 million or more

1 Jan 2025 – Businesses with an annual turnover of RM 25 million to RM 100 million

1 Jul 2025 – Business with an annual turnover if RM 500,000 to RM 25 million

1 Jul 2026 – Businesses with annual turnover of RM 150,000 to RM 500,000

However, businesses with an annual turnover of RM 150,000 will be exempted.

What can you do to prepare for Access UBS eInvoicing?

As the shift to eInvoicing approaches, here are three key steps to ensure you’re prepared for a seamless transition:

Assess Current Invoicing

Evaluate your current invoicing processes for enhanced efficiency and reduced costs. Identify areas for improvement to stay ahead in the game.

Integration with Access UBS

Integrate eInvoicing with Access UBS to automate tasks, save time, and ensure timely, error-free payments. Streamline your financial processes effortlessly!

Team & Client Education

Communication is key! Educate your teams and clients about the impending changes. Ensure everyone is on board for a smooth transition into eInvoicing.

UBS eInvoicing E-Learning Course

Learn about the basics of eInvocing the required version of UBS software, and the steps to set up and manage eInvoicing for your business. The content will be presented in easy-to-digest sections, incorporating interactive screens.

Save, Secure & Reliable

Experience peace of mind with LHDN e-Invoice – it’s safe, secure, and utterly reliable. Your data seamlessly integrates into your accounting software with just a click, streamlining your financial processes effortlessly.

Minimize Errors and Increase Efficiency

By eliminating manual tasks such as sorting, printing, and data entry, eInvoice significantly reduce the chances of human error. This streamlined process removes the potential for mistakes and saves valuable time that would otherwise be spent on invoice processing. The technology relies on standardized data, ensuring validation before the invoice reaches your accounting software and is automatically processed, guaranteeing accuracy in your financial records.

UBS Evo, your AI-powered Accounting Assistant

It’s time to expeirence the future of finance and let your AI-powered accounting companion handle your financial processes effortiessly while you focus on what matters most – growing your business. It’s not magic, it’s Evo.

Save time and increase productivity with a personal AI assistant by uploading business data.

Enabling more accuracy results with lesser time.

LHDN e-Invoicing compliance to tailored tax insights for your products or services, anytime, anywhere.

UBS Evo streamline your daily tasks with your ideas, elevating your growth to the next level.

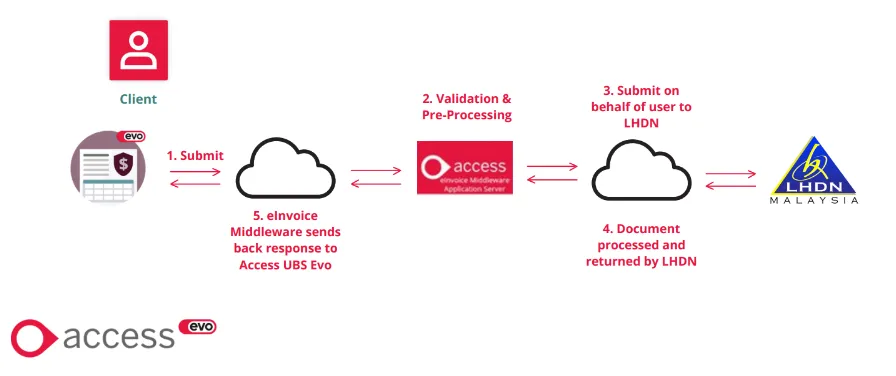

UBS eInvoicing as Intermediary Party

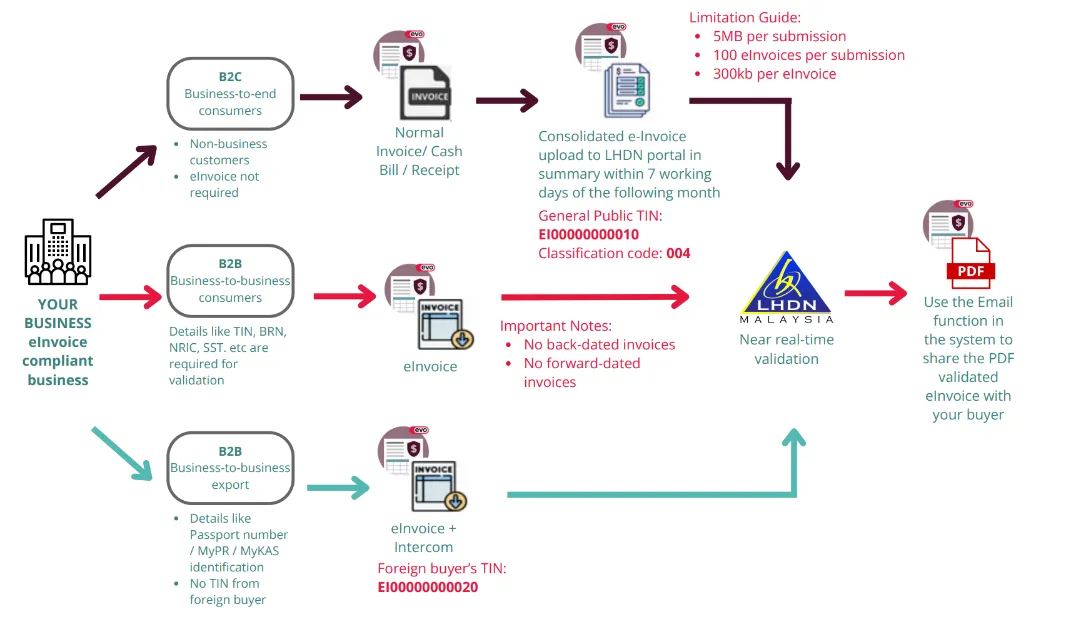

User Journey: eInvoicie scenarios

Explore eInvoicing scenarios and see how UBS Evo simplifies every step – from creation to compliance.

eInvoicing Software FAQs

Why do I need eInvoice in Malaysia?

Adopting eInvoice in Malaysia is essential for several reasons outlined in the LHDN guidelines. Firstly, eInvoice ensures compliance with the Inland Revenue Board (LHDN) regulations, helping businesses adhere to legal requirements. Secondly, it significantly reduces processing costs for each invoice, potentially up to 80%, leading to substantial savings.

Moreover, eInvoice accelerates payment processes, improving cash flow and improving businesses’ financial stability. Embracing eInvoice simplifies invoicing procedures and aligns seamlessly with the LHDN Malaysia regulations, making it a practical and efficient choice for businesses operating in Malaysia.

Why is eInvoice important to your business?

eInvoice is crucial for our business because it ensures compliance with the guidelines set by LHDN Malaysia. By adopting eInvoice, we streamline your invoicing process, reduce operational costs significantly, and enhance overall efficiency. This compliance saves time and money and ensures that our business operations align seamlessly with the regulations, guaranteeing smooth transactions and financial stability.

Why do I need eInvoice in Malaysia?

eInvoice eliminates the need for sellers to print paper invoices or create PDFs for mailing or emailing to buyers. Buyers no longer have to input invoice data into their accounting systems manually. This method enhances accuracy and security, speeding up processing times and payments.In summary, the benefits of eInvoice include:

✅Reduced administrative work for both buyers and sellers.

✅ Faster payments for sellers.

✅ Cost savings for both buyers and sellers.

✅ Fewer errors for buyers and sellers.

✅ Direct and secure connections between buyers and sellers.

✅ Reduced environmental impact.

Interested in using eInvoicing to speed up your process?

Kindly click below to request for a demo of UBS Evo and our customer support team will be in touch.